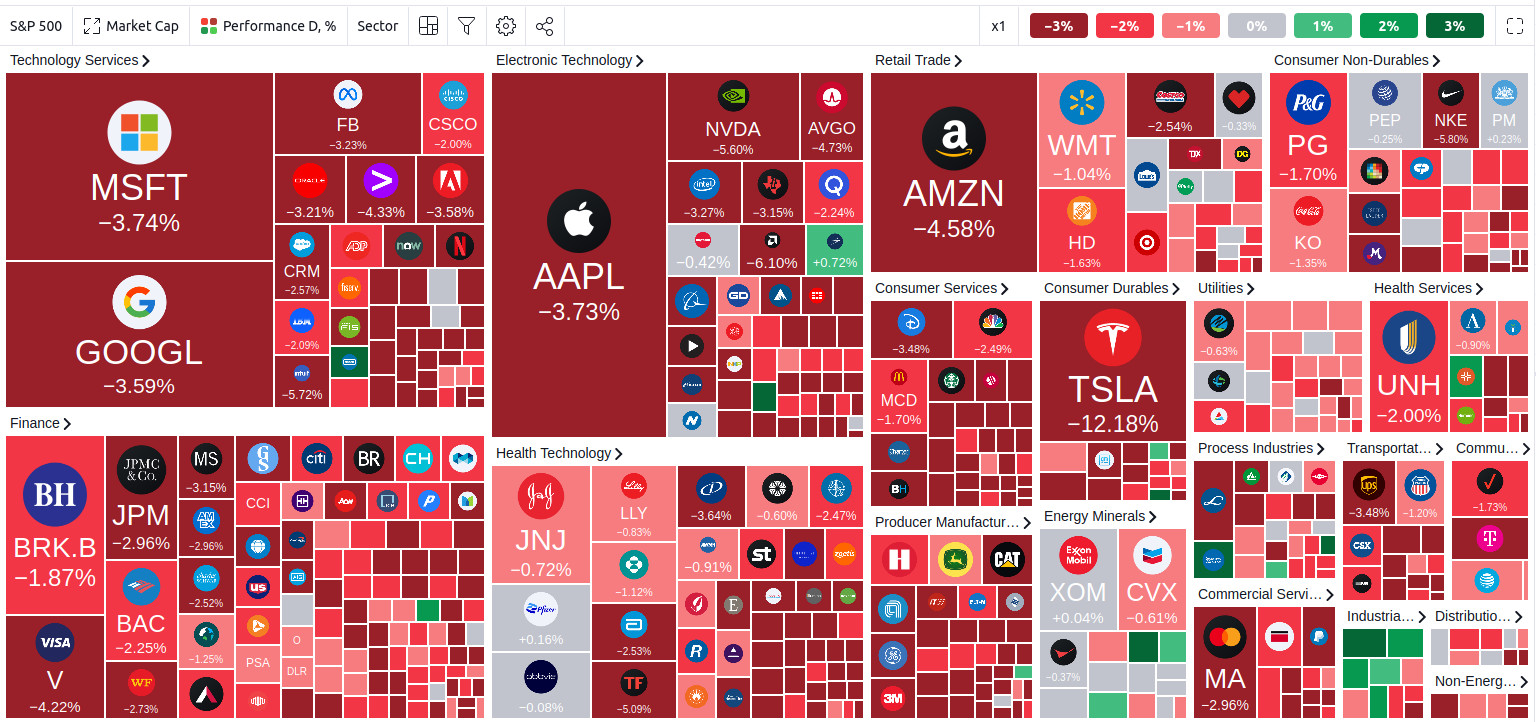

markets are ugly

Bloody hell, it’s ugly out there.

We’ve got a bit of money invested in “the markets”.

Sadly it’s all ear-marked rather than a holiday fund. Some, if not all, of it will be burnt through financing schooling for kids, and the bulk of the rest of it is currently locked up in pensions. Currently untouchable, from old corporate days when we actually made some money.

About 18 months ago I decided to manage it myself - I told myself: I’m brightish, I can match or beat the fund managers with all their restrictions.

Half wish I hadn’t.

I moved my pension into a SIPP and some of our joint ISA funds (from when we were able to save money) and put it into a few popular funds - I went a *bit tech heavy.

(*very)

During COVID lockdowns I thought I was a genius investor: up 30+% in 12 months amazing, investing is easy!

The world needs Zoom, Peleton and Netflix - it’s the future - Cathie Wood might be the next messiah, how can people not see that!

I’ve since given up all those gains and a few percent more now - fell in love with the funds or whatever, didn’t sell when I should have, and now back (a bit) below what I put in.

….and god the markets look ugly at the moment

I’ve sold out of some funds, mostly without too much loss, sometimes thinking I’ve made the right choice, other times watching it climb almost as soon as I sell, trying to tell myself to be logical, don’t panic, long term it’s all going up (or maybe the purchasing power of currency is going down…both probably true).

For the SIPP it doesn’t really matter too much, we’re not going to be looking to draw that down for about 15 years, so we’ll probably see lots more boom and bust - I should probably delete the app and stop looking at it daily….and I’ve since moved a fairly big percent to a global tracker, boring but goes up or down with the world…and long term I probably won’t beat simply sticking all funds in that.

Thankfully my wife left hers with a more professional fund manager who probably isn’t selling bottoms and buying tops quite like I am.

For the ISA’s 50% is in cash at the moment which might not be a bad thing, and would have been even better if I’d sold earlier.

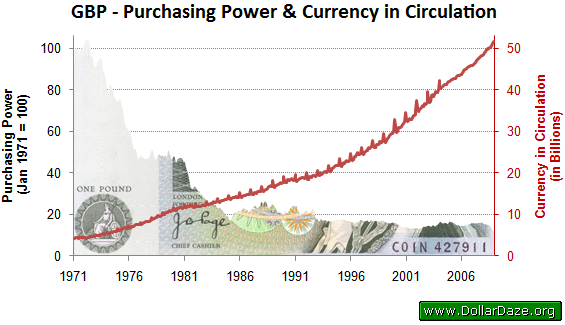

However holding cash is like holding a melting icecube of purchasing power when inflation is running at 5-7% or 15%+ if you’re not retired and trying to build stuff and grow a business.

Melting Icecube:

There’s loads of images like this online showing the decline of purchasing power of all fiat currencies since 1971 - and it’s only accelerating since the huge amount of money printing Governments did during their Covid lockdowns - doesn’t look too pretty.

I like Bitcoin and wonder if I should have some Gold.

I’m a big fan of the principle of storing value in something the government can’t print more of (hence holding land as well) - one thing that’s certain is that fiat currencies loss purchasing power over time…it’s just down to government incompetence how quickly.

Sadly it feels like BTC has been taken over by Wall St and trades like a crappy tech stock at the moment - hopefully at some point more people, and countries will recognize it for what it is and it’ll break free from the S&P / Nasdaq correlation.

Gold is perhaps too manipulated by the big banks, but I guess one day might break free.

I want rid of the cash but can’t see anything that I want to invest it in….and I need some capital growth to hit my spreadsheet targets for funding future expenses.

Ugh.

I’m sure it’ll settle down, but at the moment it all looks like a bag of shit, so I guess I’ve got to do nothing and sit on my hands.

(breathe….a few years from now this will be an inconsequential blip on the chart….fingers crossed)